Ashcroft Capital has established itself as a premier player in the real estate investment industry, particularly known for its Value-Add Fund strategies. These strategies are designed to transform underperforming multifamily properties into high-performing assets, generating substantial returns for investors. This article delves into the strategies employed by Ashcroft Capital’s Value-Add Fund, providing insights into their approach and highlighting the key factors that contribute to their success.

Understanding the Value-Add Strategy

What is a Value-Add Strategy?

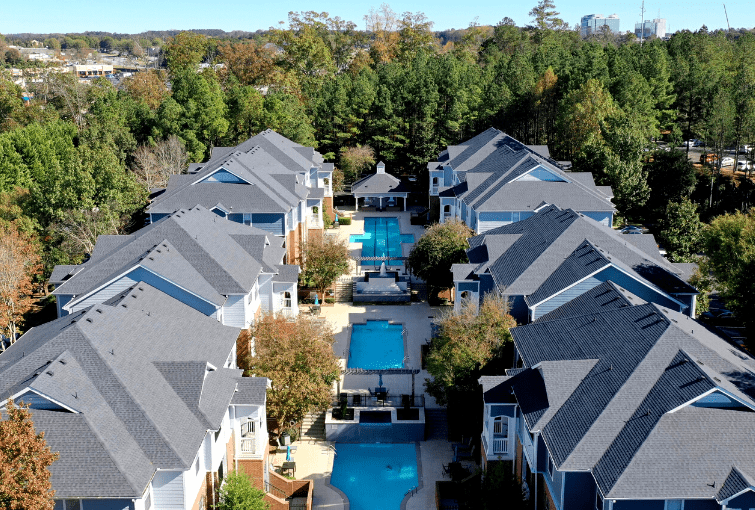

The value-add strategy involves acquiring properties that are not performing at their full potential due to various factors such as deferred maintenance, outdated amenities, or inefficient management. The goal is to enhance the property’s value through targeted improvements and operational efficiencies. Once these enhancements are implemented, the property can command higher rents and achieve better occupancy rates, leading to increased revenue and property value.

Ashcroft Capital’s Approach

Ashcroft Capital employs a meticulous approach to its value-add strategy. This involves identifying properties in markets with strong economic fundamentals, implementing comprehensive renovation plans, and managing the properties efficiently to maximize returns. Their approach is characterized by thorough market analysis, strategic planning, and a hands-on management style.

Market Selection

Identifying High-Growth Markets

One of the critical elements of Ashcroft Capital on Commercial Observer value-add strategy is the careful selection of markets. The firm focuses on high-growth markets where there is robust economic activity, population growth, and job creation. These factors ensure a strong demand for rental housing, which is essential for the success of value-add investments.

Criteria for Market Selection

Ashcroft Capital uses several criteria to select markets for their value-add investments. These include:

- Economic Indicators: The presence of a diverse and growing economy with low unemployment rates.

- Population Trends: Areas experiencing significant population growth, particularly among young professionals and families.

- Housing Demand: High demand for rental properties, coupled with a shortage of quality housing options.

- Regulatory Environment: Favorable regulatory conditions that support property improvements and management.

Property Acquisition

Due Diligence Process

Before acquiring a property, Ashcroft Capital conducts an extensive due diligence process. This involves a thorough analysis of the property’s current condition, financial performance, and market potential. Key aspects of the due diligence process include:

- Physical Inspection: Assessing the property’s structural integrity, mechanical systems, and overall condition.

- Financial Analysis: Reviewing the property’s financial records, including income, expenses, and potential for rent increases.

- Market Analysis: Evaluating the local market conditions, including competition, rental rates, and occupancy trends.

Negotiation and Acquisition

Once a property passes the due diligence phase, Ashcroft Capital engages in negotiations to acquire it at a favorable price. The firm leverages its extensive industry relationships and market knowledge to secure properties that offer significant value-add potential. The goal is to acquire properties below market value, providing a strong foundation for future appreciation.

Renovation and Repositioning

Comprehensive Renovation Plans

After acquiring a property, Ashcroft Capital implements a comprehensive renovation plan. These plans are tailored to address the specific needs of each property and typically include:

- Interior Upgrades: Renovating individual units with new flooring, appliances, fixtures, and finishes to enhance appeal and functionality.

- Exterior Improvements: Enhancing the property’s curb appeal through landscaping, exterior painting, and structural repairs.

- Amenity Enhancements: Upgrading or adding amenities such as fitness centers, swimming pools, and community spaces to attract and retain tenants.

Repositioning Strategy

In addition to physical improvements, Ashcroft Capital employs a repositioning strategy to enhance the property’s market position. This involves rebranding the property, implementing new marketing strategies, and improving property management practices. The goal is to create a desirable living environment that appeals to the target tenant demographic.

Efficient Property Management

Professional Management Teams

Efficient property management is crucial to the success of Ashcroft Capital’s value-add strategy. The firm partners with professional property management companies that have a proven track record of success. These management teams are responsible for day-to-day operations, including leasing, maintenance, and tenant relations.

Operational Efficiencies

Ashcroft Capital focuses on implementing operational efficiencies to reduce costs and improve property performance. This includes:

- Energy-Efficient Upgrades: Installing energy-efficient appliances, lighting, and HVAC systems to reduce utility costs.

- Technology Integration: Utilizing property management software and data analytics to streamline operations and make informed decisions.

- Cost Control Measures: Implementing rigorous cost control measures to ensure that renovation and operational expenses are kept in check.

Financial Performance and Returns

Revenue Enhancement

The value-add strategy aims to enhance revenue through increased rental income and improved occupancy rates. By upgrading the property and enhancing its appeal, Ashcroft Capital can justify higher rents and attract high-quality tenants. This results in a steady and increased stream of rental income.

Property Appreciation

In addition to rental income, the value-add strategy leads to significant property appreciation. The comprehensive renovations and repositioning efforts increase the property’s market value, providing substantial returns upon sale or refinancing. This appreciation is a key driver of overall investment performance.

Investor Returns

Ashcroft Capital’s value-add strategy is designed to deliver strong returns to investors. The firm typically targets annual returns in the range of 15-20%, with a significant portion of the returns coming from property appreciation. Investors benefit from both the steady cash flow generated by rental income and the capital gains realized upon the sale of the property.

Risk Management

Mitigating Investment Risks

While the value-add strategy offers significant upside potential, it also involves certain risks. Ashcroft Capital employs several risk management strategies to mitigate these risks, including:

- Thorough Due Diligence: Conducting extensive due diligence to identify potential issues before acquisition.

- Diversification: Diversifying the portfolio across multiple properties and markets to spread risk.

- Contingency Planning: Setting aside reserves for unforeseen expenses and market fluctuations.

Long-Term Focus

Ashcroft Capital maintains a long-term focus in its investment strategy. By holding properties for an extended period, the firm can weather short-term market fluctuations and capitalize on long-term market trends. This approach ensures that investors benefit from both current income and long-term appreciation.

Conclusion

Ashcroft Capital’s Value-Add Fund exemplifies a strategic and disciplined approach to multifamily real estate investment. Through careful market selection, thorough due diligence, comprehensive renovation plans, and efficient property management, the firm transforms underperforming properties into high-performing assets. This value-add strategy not only enhances the quality of the properties and improves the living experience for tenants but also delivers substantial returns to investors. By continuously refining its approach and leveraging its expertise, Ashcroft Capital remains a leader in the multifamily investment space, setting the standard for success in value-add real estate investments.